Because it is only required once a year, it can be easy to forget how to complete your SEMPRIS policy renewal form as quickly and efficiently as possible.

We hope you will therefore find the following guide useful.

NB Please do not complete your form until you have all the information available to you and can do so in one sitting. Information you will require is:

- Your personal details: GMC Number, Email (the same email address to which your renewal invitation was sent) and Address;

- Your practice details: Session numbers and the number and type of procedures performed in your private practice over the past year;

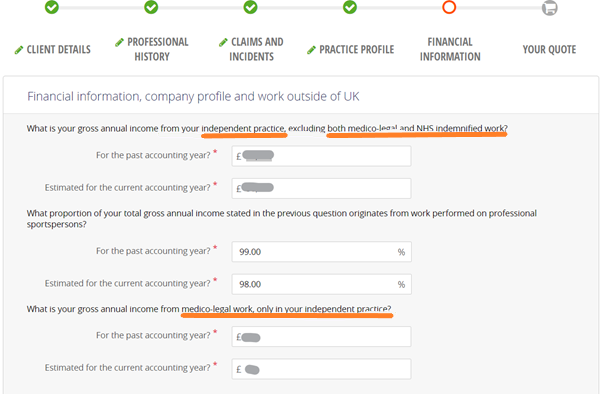

- Your financial information: Private practice income figures for the past accounting year, separating out income relating to professional sports practice and medico-legal work;

- Claims information: please speak with any secretarial/administrative staff to ensure that you have reported to us all circumstances which might give rise to claim. If you need to report any claims or circumstances, please call 0333 010 2826 prior to the completion of your renewal application.

Your reminder

Around a month ahead of your renewal date, you will receive a message from noreply@sempris-online.co.uk, entitled Your SEMPRIS Renewal. This will contain a link, which will take you directly to the online system, where you can log back into your account.

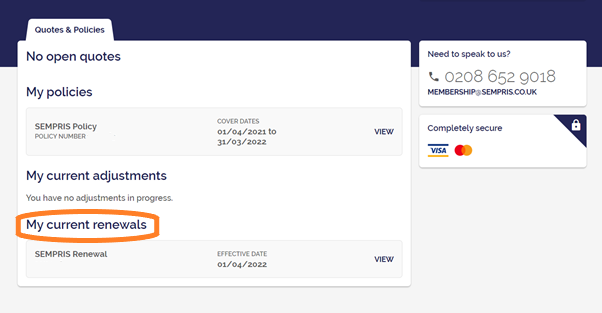

You should then see a dashboard which looks a little like this, allowing you to view your current policy (under My policies) and your renewal information (under My renewals, circled in orange):

If you click on VIEW, the renewal form is fully integrated into the website, to check, amend and add all your details. If you have any questions or concerns, as always, we will be available to assist by phone or email. We would encourage you to discuss any options with us and to make sure your policy fully reflects your practice and the continuing, extraordinary circumstances.

Notes on the completion of your renewal form

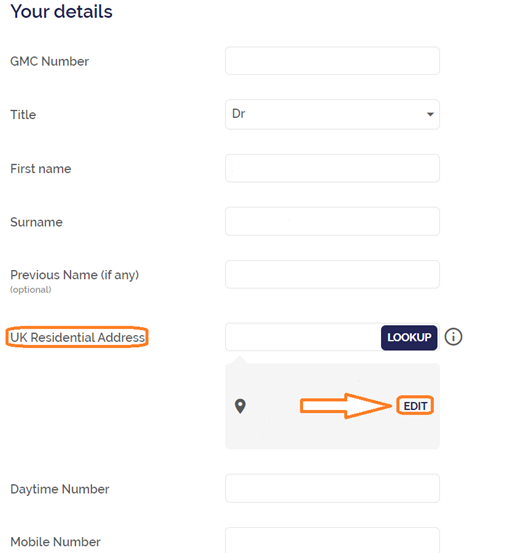

Please don’t forget to update your contact details, including your home address:

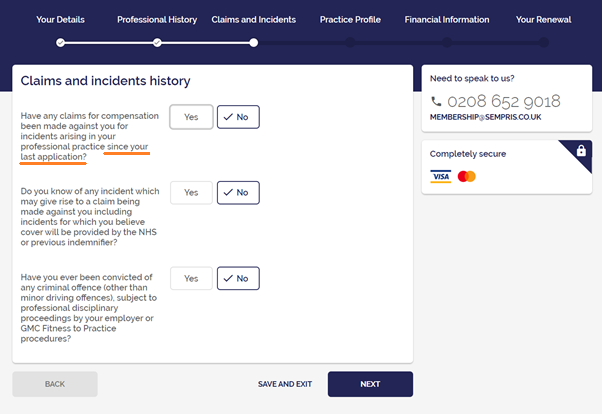

Any claims already notified to SEMPRIS Support / the medicolegal team do not need to be noted on the form; the underwriters are asking about new claims or incidents since last year’s application:

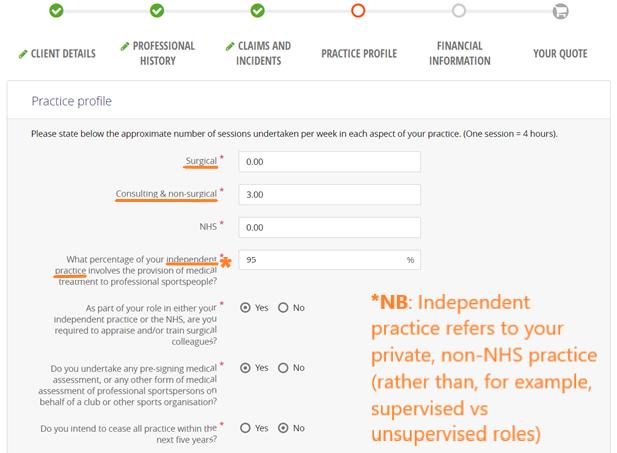

Please ensure that your session numbers and percentage of sports work reflect only your non-NHS practice (the number of NHS sessions requested allows the system to calculate the total hours worked and to flag if this is too many):

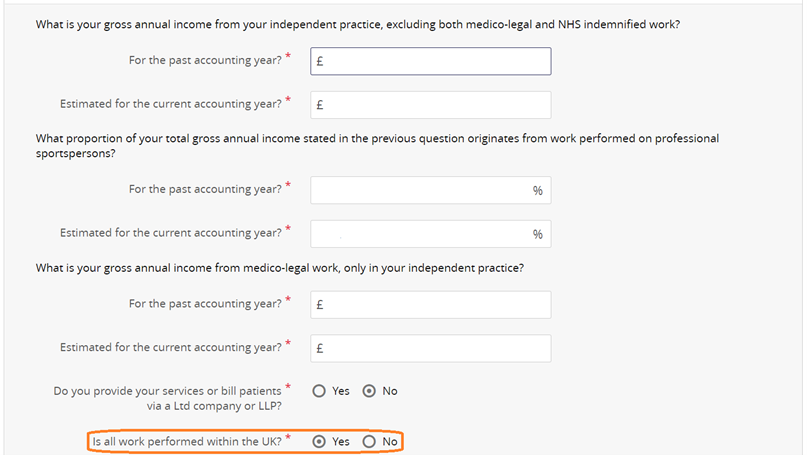

Please EXCLUDE NHS practice from your income figures, and please SEPARATE medico-legal income, which is requested in the third set of figures.

If you are a club doctor, we would expect to see 100% of your gross annual income originating from work performed on professional sportspeople; if this is not accurate for you, please also send us an email to explain what makes up the balance of your work.

Please ensure that you declare any potential travel outside the UK for work (with or without a sports team); be sure to familiarise yourself with the territorial and jurisdictional limits of the policy and ask us if you have any questions.

⚠ Please note that the Financial Information page is the final page of the form, and clicking NEXT on this page will submit your form to us for checking before referring to underwriters for your renewal quotation. Any changes required after this stage will need to be made by contacting SEMPRIS (by email or by telephone as usual).

Reminders about your renewal options

- Your quotation table will present indemnity limit options of:

- £10m Any One Claim and £20m in the Annual Aggregate

- £15m Any One Claim and £30m in the Annual Aggregate

- £20m Any One Claim and £40m in the Annual Aggregate

- Excess Options – Just as with any form of insurance, these can be used to lower premiums. The table will show the impact of each of the excess options on the premium payable. Please note that, once selected, they remain in place for the duration of the annual contract and cannot be changed. Excesses are only payable in respect of clinical negligence claims and only then when it is necessary to draw in the services of external lawyers. They are not payable in circumstances such as GMC inquiries, fatal inquests or any other non-negligence related circumstance.

- With so many unknowns still surrounding practice levels and incomes, we would still encourage members to consider the option of spreading their indemnity cost by instalments via Premium Credit Limited. PCL charge an admin fee and an interest rate (variable) to use this facility, and the total cost of this option is indicated at the payment stage, once you have accepted your quote. PCL understand and are sympathetic to the current challenging circumstances and encourage new and existing members who use or wish to use the facility to contact them directly on 0344 736 9836

Please note: When completing your renewal form, you are responsible for making, after reasonable search, a Fair Presentation, in a clear and accessible manner, of all important and relevant information, at least sufficient to put a prudent insurer on notice to make enquiries and not to make any misrepresentations as required by the Insurance Act 2015.

A Fair Presentation is required in order for a reasonable insurer to decide whether to provide insurance or not and, if so, the terms and conditions of such insurance. The use of an application or proposal form supplied by insurers or Paragon does not relieve or reduce your responsibility to make a Fair Presentation of important and relevant information in a clear and accurate manner. If you do not make a Fair Presentation, then insurers may be able to:

• void the policy and provide no coverage with no return of premium.

• amend the terms of the insurance placement to exclude coverage under the policy.

• reduce the value of claims to be paid.

• charge you additional premium.

Your obligation to keep information up to date is on-going and therefore we ask that you advise us as soon as possible of any changes in respect of any of the information you have provided, so that we can pass such changes onto insurers for their acceptance or otherwise.

Underwriters are not bound to hold cover on your expiring indemnity policy if your renewal form is not returned within the prescribed timeframe stated above. If the form is not completed and returned to us before your renewal date, underwriters reserve the right to cancel your policy, resulting in a gap in cover and placing you in potential breach of GMC regulations.

As a gentle reminder, please ensure you report all potential circumstances to us on 0333 010 2826 and note the circumstances on this years’ renewal form. If you have any questions, please do not hesitate to contact us.

More GuidelinesShare this post:

- - -