We have produced this guide to assist you in completing your SEMPRIS policy proposal form as quickly and efficiently as possible. We hope you find it useful.

NB Please do not complete your form until you have all the information available to you and can do so in one sitting. Information you will require is:

Your personal details: GMC Number, Email and Address;

• Your practice details: Session numbers and the number and type of procedures performed in your private practice over the past year, as well as an approximation of the amount of pro sports work this includes;

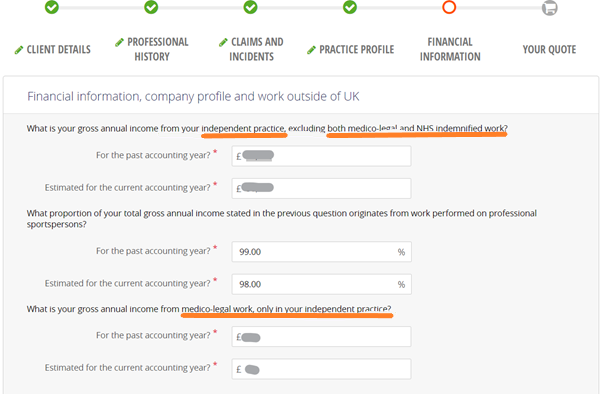

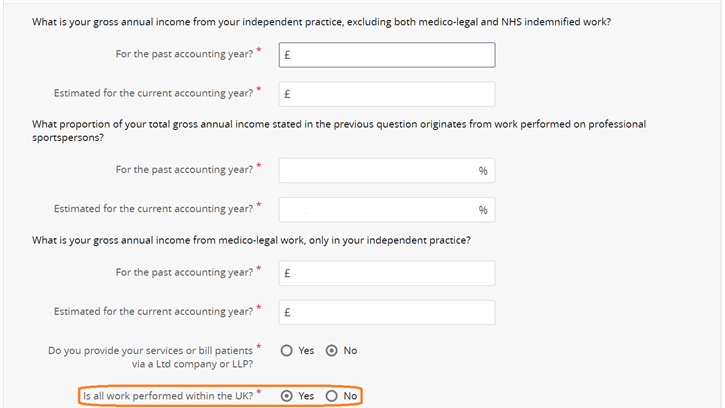

• Your financial information: Private practice (excluding NHS) income figures for the past accounting year and for the current accounting year, separating out income relating to professional sports practice and medico-legal work;

• Claims information: please ensure that you include details of any open claims, as well as any circumstances which might give rise to claim.

Please include details of your full practice (excluding NHS work) – we are unable to split out one area of your practice and need to take on the full scope of your private practice. NHS practice is already covered by the CNST / CNORIS, and we are unable to cover this (as it would constitute dual indemnity for the same work).

If you have any questions or concerns, we are available to assist by phone or email.

Notes on the completion of your proposal form

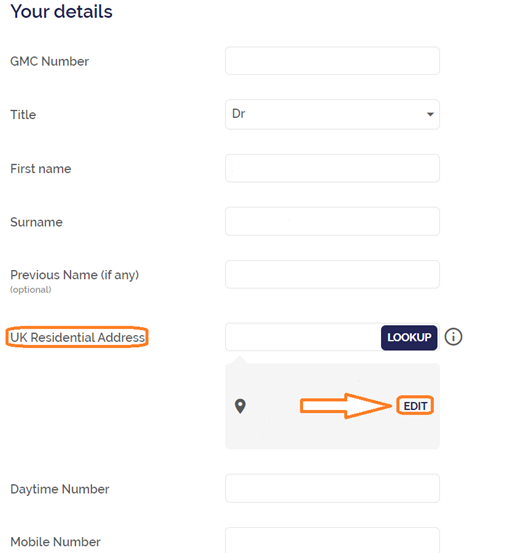

Please don’t forget to include your contact details, including your home address (we are unable to accept a hospital, club or clinic address):

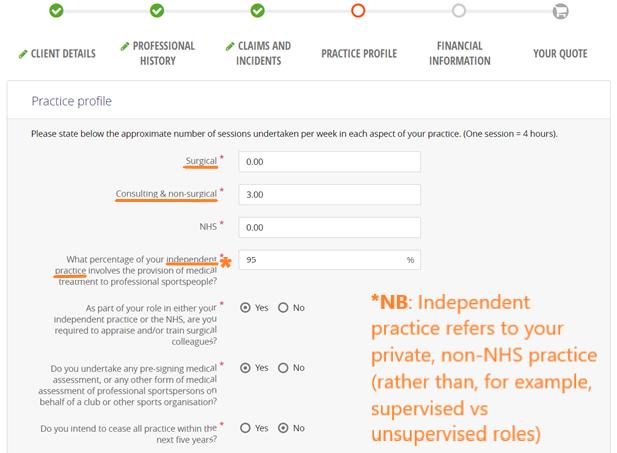

Please ensure that your session numbers and percentage of sports work reflect only your non-NHS practice (the number of NHS sessions requested allows the system to calculate the total hours worked and to flag if this is too many):

Please EXCLUDE NHS practice from your income figures, and please SEPARATE medico-legal income, which is requested in the third set of figures:

If you are a club doctor, we would expect to see 100% of your gross annual income originating from work performed on professional sportspeople; if this is not accurate for you, please also send us an email to explain what makes up the balance of your work.

When asked whether all work takes place within the UK, please ensure that you declare any potential travel outside the UK for work (with or without a sports team); be sure to familiarise yourself with the territorial and jurisdictional limits of the policy and ask us if you have any questions.

⚠ Please note that the Financial Information page is the final page of the form, and clicking NEXT on this page will submit your form to us for checking before referring to underwriters for your renewal quotation. Any changes required after this stage will need to be made by contacting SEMPRIS (by email or by telephone as usual).

Reminders about your policy options

SEMPRIS indemnity is written on a claims made* basis, and is designed to provide cover for all private practice, including NHS issues that are not covered by Crown Indemnity (e.g. GMC inquiries, disciplinary hearings etc.) but provides additional and crucial cover, namely for third party and subrogated claims, for Consultants who treat professional sportspeople of any level / sport.

- Your quotation table will present indemnity limit options of:

- £10m Any One Claim and £20m in the Annual Aggregate

- £15m Any One Claim and £30m in the Annual Aggregate

- £20m Any One Claim and £40m in the Annual Aggregate

- Excess Options – Just as with any form of insurance, these can be used to lower premiums. The table will show the impact of each of the excess options on the premium payable. Please note that, once selected, they remain in place for the duration of the annual contract and cannot be changed. Excesses are only payable in respect of clinical negligence claims and only then when it is necessary to draw in the services of external lawyers. They are not payable in circumstances such as GMC inquiries, fatal inquests or any other non-negligence related circumstance.

- With so many unknowns still surrounding practice levels and incomes, we would still encourage members to consider the option of spreading their indemnity cost by instalments via Premium Credit Limited. PCL charge an admin fee and an interest rate (variable) to use this facility, and the total cost of this option is indicated at the payment stage, once you have accepted your quote. PCL encourage new and existing members who use or wish to use the facility to contact them directly on 0344 736 9836

Please note: When completing your proposal form, you are responsible for making, after reasonable search, a Fair Presentation, in a clear and accessible manner, of all important and relevant information, at least sufficient to put a prudent insurer on notice to make enquiries and not to make any misrepresentations as required by the Insurance Act 2015.

A Fair Presentation is required in order for a reasonable insurer to decide whether to provide insurance or not and, if so, the terms and conditions of such insurance. The use of an application or proposal form supplied by insurers or Paragon does not relieve or reduce your responsibility to make a Fair Presentation of important and relevant information in a clear and accurate manner. If you do not make a Fair Presentation, then insurers may be able to:

• void the policy and provide no coverage with no return of premium.

• amend the terms of the insurance placement to exclude coverage under the policy.

• reduce the value of claims to be paid.

• charge you additional premium.

Your obligation to keep information up to date is on-going and, therefore, we ask that you advise us as soon as possible of any changes in respect of any of the information you have provided, so that we can pass such changes onto insurers for their acceptance or otherwise.

If you have any questions, please do not hesitate to contact us.

*A claims made policy requires continuous cover to be maintained, even with another insurer (this is very standard practice among claims made indemnifiers). If you are moving to SEMPRIS from another claims made indemnifier, and have held continuous cover, we will pick up your retroactive date and will cover all your work from that date onwards. If you subsequently move away from SEMPRIS, you will need to ask your new indemnifier to pick up your retroactive date to ensure continuous cover. If you move to a new indemnifier who will not provide you with the retroactive cover you would need for the duration of your membership under SEMPRIS, it is possible to purchase run-off cover (typically priced around 100% of the expiring premium in the first year, with this decreasing year-on-year along with the risk of an associated claim).

More GuidelinesShare this post:

- - -