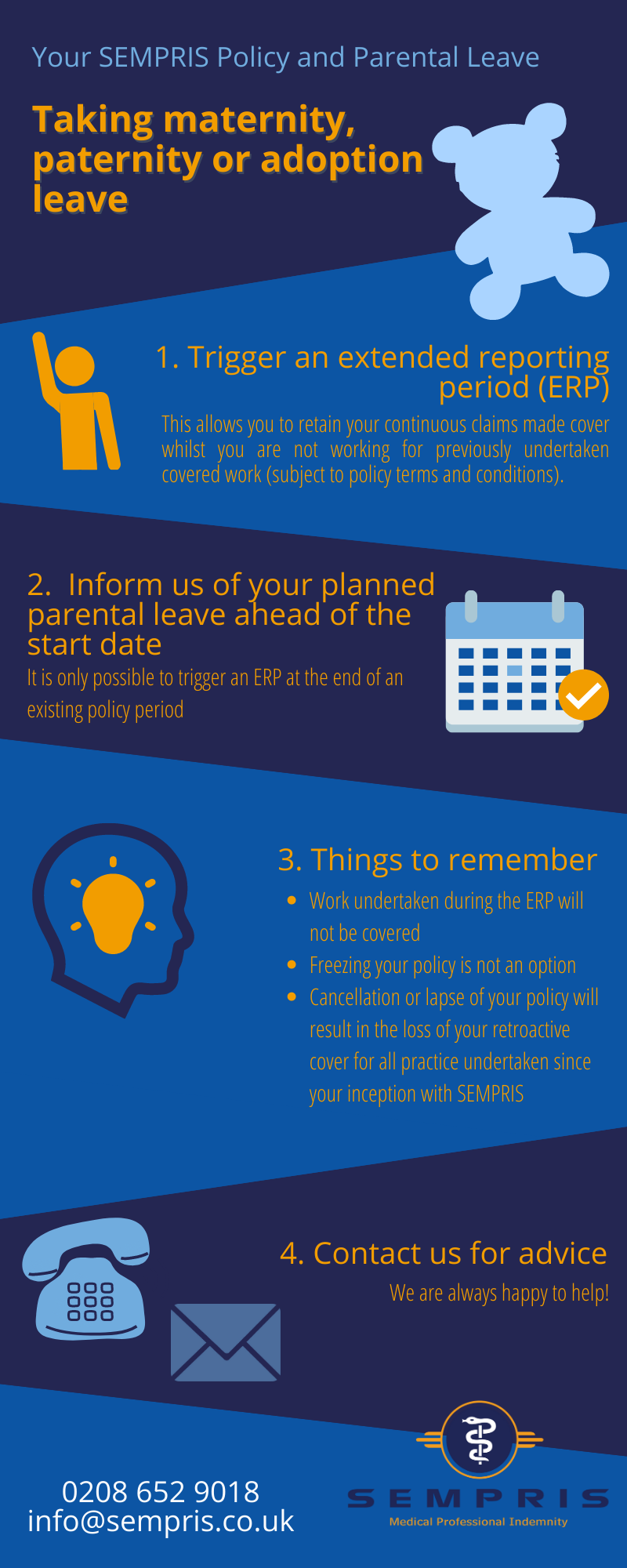

How we can help

If you will be on maternity, paternity or adoption leave (parental leave) with no work at all, you can trigger an extended reporting period (ERP) for up to 12 months at no additional cost.

This allows you to retain your continuous ‘claims made’ cover whilst you are not working for previously undertaken covered work (subject to policy terms and conditions).

What you need to do

Please ensure that you inform us of your planned parental leave ahead of the start date.

It is only possible to trigger an ERP at the end of an existing policy period. If you are already anticipating being on parental leave at the renewal of your policy, it is worth discussing this with us, as it may be preferable to consider extending your current policy for a suitable amount of time (up to a maximum of 6 months), to allow you to trigger your ERP at the end of your (extended) policy.

Things to remember

- Any work undertaken during the ERP (whether paid or unpaid) will not be covered, and will render the ERP invalid.

- Suspending or freezing your policy is not an option. Notwithstanding GMC regulations concerning indemnity, your SEMPRIS policy is written on a ‘claims made’ basis. To ensure that full retroactive cover for your practice since inception (or since your retroactive date if earlier) remains in place, continuous cover to be maintained.

- At the inception or renewal of a policy, the underwriting model that underpins all ‘claims made’ indemnity schemes notes actual past year’s and estimated current year’s income, together with session and procedure numbers and other risk factors. Any variation, whether up or down, is reflected at the annual renewal of the policy. Lloyds underwriters are not able to make mid-term adjustments or refunds on policies.

If, for example, you wish to undertake work during your parental leave but anticipate a reduction in your earnings, you would need to continue with your standard SEMPRIS policy, and we would recommend that you include this in your renewal declaration. Similarly, if you have seen a significant reduction in your earnings compared to what was declared at your previous renewal due to parental leave, please ensure that this is declared on your next renewal form.

Please note: as SEMPRIS offers ‘claims made’ policies covering all declared work back to your retroactive date, your policy is priced and weighted on work already carried out. Therefore, any reduction will not be directly proportionate to the reduction in your work / income.

- Most importantly, cancellation or lapsing of your SEMPRIS policy will result in the loss of your retroactive cover for all practice undertaken since your inception with SEMPRIS. This is why we advise that, if you change provider, you should ensure that they pick up your retroactive date (this is very standard practice among PI providers).

For relevant sections of your policy wording, please see pages 3, 10 and 16 of your Medical Professional Liability Wording (which you should have received automatically upon inception or renewal of your policy, and which is available in your account on the secure online system at any time).

As ever, please don’t hesitate to pick up the phone or email us if you would like to discuss any of the above or your own personal circumstances. We are always happy to help.

Neil Redman, Lorna Hastings & Jeanette Hoskins

SEMPRIS

0208 652 9018

info@sempris.co.uk

More ArticlesShare this post:

- - -